ARTICLE | 5 MIN READ

Sage Intacct: The Best Multi-entity, Multi-location, and Multi-currency Accounting Software

How Sage Intacct makes managing financials for multiple entities, locations, and currencies easy.

Sage Intacct is powerful cloud accounting software that automates currency conversations and inter-entity transactions to eliminate error-prone manual input. With its centralized internal controls and deep accounting features, your data is more timely, accurate, and reliable—which means you’ll close the books faster and jumpstart growth. Here’s how Sage Intacct brings disparate data together.

Manage multiple entities with one login

With Sage Intacct, you can manage multiple lines of business with one login and quickly compare performance across entities. Choose your reporting currency and language, and tailor account titles to local regulations. You can even toggle between consolidated and regional views for further insights. Thanks to Sage Intacct’s cloud platform, this data is available whenever and wherever you need it.

Entity set-up is easy and instantaneous; you can create new entities with configurable rules for inter-entity transactions. Each new entity inherits information based on existing lists, process definitions, and charts of accounts.

If you’d like to configure a new entity with unique definitions, that’s also possible! Simply pick and choose what information you want to auto-populate and fill in the rest. You’re in charge of these entities, so feel free to centralize payables and receivables, develop multiple charts of accounts, and more—all with just one login.

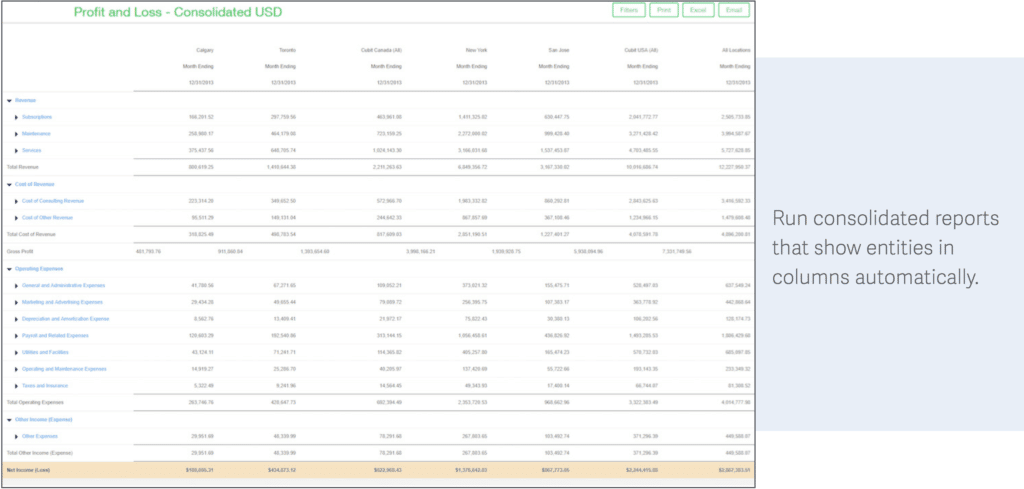

View business lines individually and together with consolidated reporting

Many accounting solutions allow users to filter information in reports based on accounts, business units, departments, and other factors. For Sage Intacct, dimensions play a crucial role in how you filter this information, and you can tag items by dimensions like location, division, and more to slice and dice data in unique ways.

With all your entities and locations in one system, it’s easy to roll everything into a consolidated report that gives you a global view of your business. This way, you cut plenty of manual work before running reports, making automated inter-company transactions more manageable than ever.

In addition, dimensional tagging lets you look at sales data in new ways. View individual lines of business or compare different ones with factors like locations, expenses, and divisions. Dimensions provide a consolidated view of your business units while also letting you drill down and compare performance.

Juggle multiple currencies with automation

Managing multiple currencies is entirely automated with Sage Intacct, which means you can save time and increase accuracy. Sage Intacct uses up-to-date exchange rates to calculate currency conversions and revaluations, ensuring you get the most for your money with each transaction. The software even supplies instant access to information on currency gains and losses. Plus, you have the flexibility to produce reports in your home office’s currency or each entity’s local currency.

This balance of efficiency and effectiveness contributes to all your transactions, so you’ll never have to worry about triple-checking rates or jumping through virtual hoops. Everything is done in real-time through the software so you can close the books faster than before.

Beyond the multi-verse: global consolidations

But what about corporations with worldwide activities? Can Sage Intacct streamline data of that magnitude?

The answer is yes!

The most significant benefit of Sage Intacct’s dimensional chart of accounts and multi-entity structure is the software’s streamlined and automated consolidations. Read more about the benefits of Sage Intacct’s global consolidations on our blog!

Let’s Chat

Still have questions? Get in touch with our expert team of software professionals.