Microsoft Dynamics GP Features

With Dynamics GP’s ERP tools, you can take control of the quote to cash process, manage your human resources and payroll needs, and gain crucial insight into your overall performance.

Take Control

Intercompany transactions. Set up and maintain relationships between companies so that intercompany transactions can be recorded automatically.

Multicurrency management. Take control of multinational operations and manage currency transactions smoothly and efficiently with multicurrency capabilities like reevaluation.

Budgeting. Track multiple budgets for multiple fiscal years in multiple currencies and GL accounts. View your budgets against your actual expenses by year, quarter, or month.

Cash flow management. Control, predict, and monitor inflows and outflows to track liquidity over time. Use a calendar view to track your inflows and outflows in an easy-to-understand format.

Grant management. Automate grant management processes to track funds more easily, demonstrate accountability, prevent overspending, and help attract future funding.

Fixed asset management. Improve financial control with tools for tracking, analyzing, and manipulating fixed assets. Track and depreciate assets by calendar or fiscal year.

Project accounting. Maintain control over project direction, costs, execution, and budget; support resources effectively. Ensure accurate billing and accounting through tight integration with financials, inventory, and accounts receivable.

Time and expense management. Capture, review, and approve project timesheets and expense reports.

Human resources management. Support customizable hiring processes, scheduling, pay rates, and performance evaluation tools.

Payroll. Automate payroll processing, transfer data from ADP/PC Payroll for Windows into your General Ledger, and directly deposit funds with ACH files.

Keep Track of Everything

General ledger. Maintain your financial journal entries and budgets with a double-entry accounting ledger that supports up to 999 periods, multidimensional analysis, revenue recognition, and intercompany transactions.

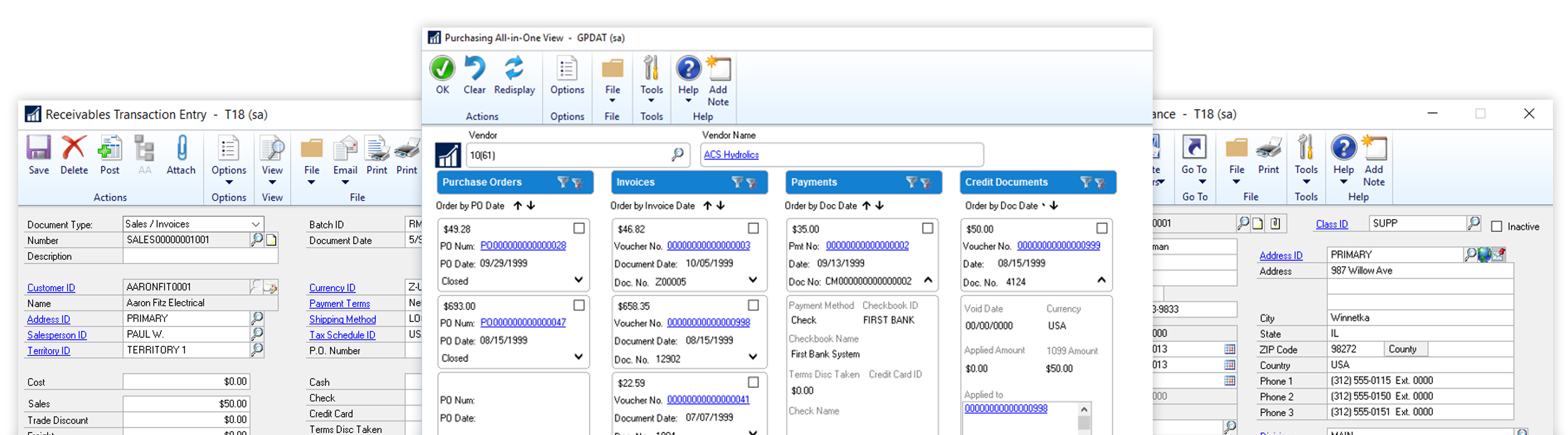

Payables management. Automate routine and complex AP tasks with real-time statistical history, easy reconciliation, account control, payment scheduling, and check printing. Track vendor details, including multiple ship-to addresses, payment terms, credit limits, vendor items, and more.

Receivables management. Automate invoicing, receipts, finance charges, and statements. Set up and maintain customer records, including credit limit, contact names, aging balances, and more.

Deferrals. Simplify deferring revenues or distributing expenses by making entries for future periods within General Ledger, Receivables Management, Payables Management, Sales Order Processing, Purchase Order Processing, and Invoicing.

Bank reconciliation. Create, manage, and reconcile from your checkbook ledger to the bank’s account records through a single, automated process across multiple currencies.

Cash management. Attach unlimited checkbooks to your bank, make bank transfers, enter General Ledger, Receivables Management, and Payables Management transactions, post batches, and build deposits for your bank transactions. Import your bank statements and reconcile transactions at any time.

Electronic bank management. Streamline setup, entry, maintenance, and reconciliation for all transactions that appear on your bank statement, including payments to creditors, cash receipts from debtors, and bank charges.

Bill of Materials. Increase productivity with fast, flexible tracking of components and subassemblies used in light manufacturing and similar production and assembly operations. Bill of Materials is used for assembling materials into finished goods.

Inventory control. Monitor inventory stock levels and costs, and set prices on a customer-by-customer basis. Use multiple costing methods, tiered pricing, alternate vendors, and serial/lot tracking. For added flexibility, multiple locations and bins are available with tracking reason codes for transfers and cycle counts.

Landed cost. Track and update the true cost associated with an inventory item and then automatically assign or modify costs as items are received.

Purchase order processing/receiving. Manage commitments and build lasting vendor relationships with automated purchasing and approval processes, flexible extended pricing, and blanket purchase orders. Receive partial shipments with discounts, landed costs, and prepayments. With tolerance handling, receive items within a threshold percent of the purchase order.

Requisition management. Allow people to request purchases needed to run your business and for personal use with a workflow process that includes the necessary approvals, process steps, and accounting.

Sales order processing. Track quotes, orders, backorders, and invoices and allow discounts per item and partial shipments. Enable quicker sales with suggested items that offer upsell opportunities and substitutions for items that are out of stock.

Manufacturing order processing. Track and manage the entire cycle of order processing, including detailed production costs, work orders, routings, outsourcing, and work center definitions.

Master production scheduling. Gather information from sales forecasts to form a single, comprehensive production schedule and automatically create manufacturing orders.

Materials requirements planning. Ensure proactive planning, smart procurement decisions, and precise adjustments to production with flexible planning and analysis capabilities in addition to viewing material requirements and vendor information.

Gain Valuable Insight

Management Reporter. Create, distribute, and analyze financial statements.

Excel reports. Take advantage of more than 400 built-in Excel reports that connect directly to the data source.

Power BI. Microsoft’s most powerful reporting tool includes several premade dashboards and reports that connect directly to Dynamics GP.

Explore Our Dynamics GP Resources

Recent Articles

Check out our blog for helpful information about the role technology plays in finance and operations.

Dynamics GP System Requirements

What do you need to get Dynamics GP up and running for your business? Check out our list of system requirements.

The Future of Dynamics GP Webinar

Watch our webinar about the future of Dynamics GP. Learn what Microsoft has planned for the product and how that impacts your business.

Request a Personalized Demo

See Dynamics GP’s features in action. Contact our team for a personalized demo.