Rated #1 in Customer Satisfaction

Let Sage Intacct make your life easier so you can focus on growing your business.

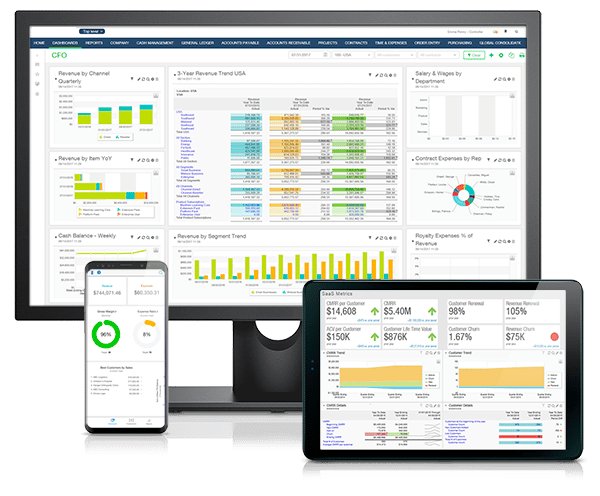

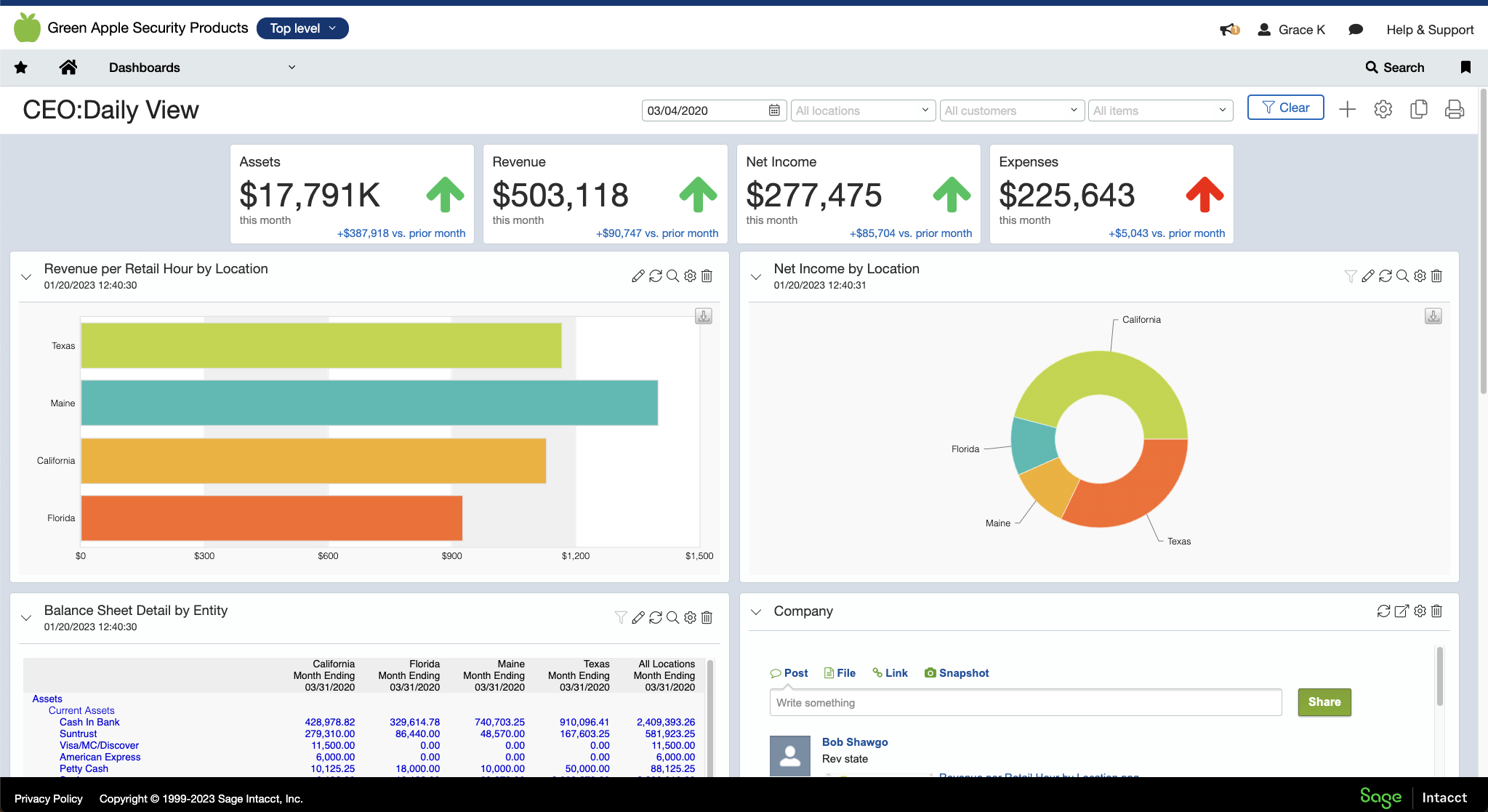

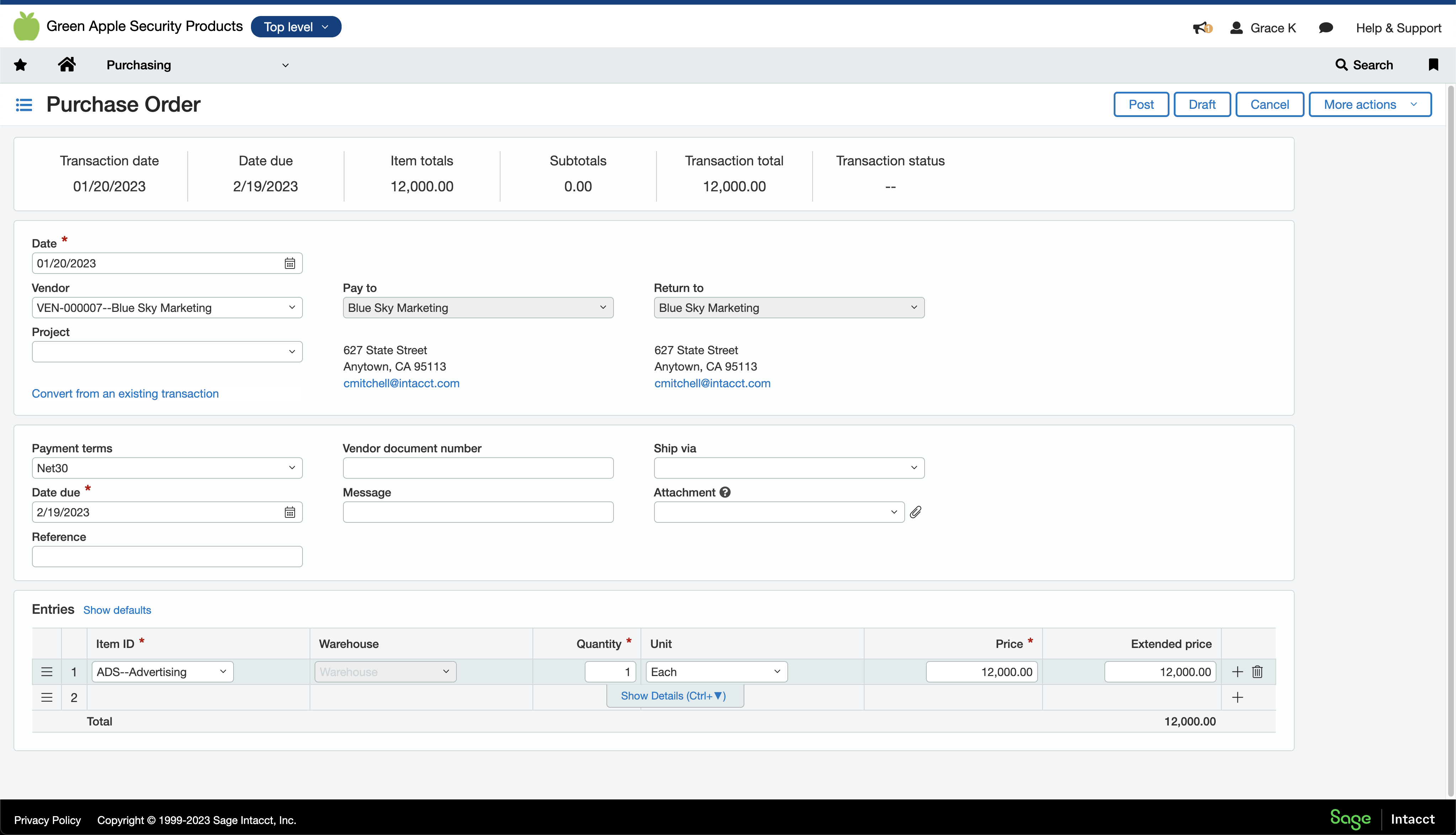

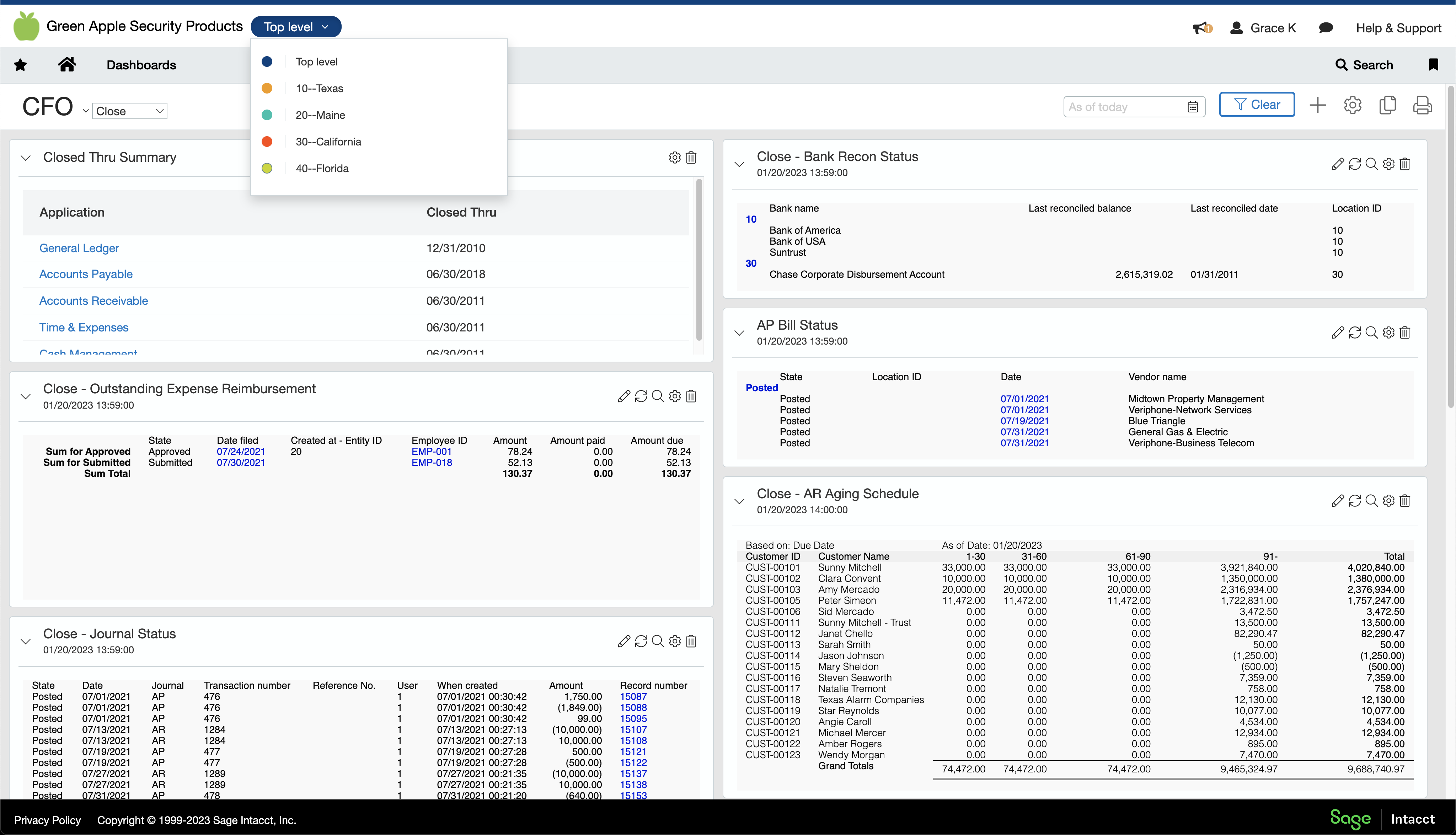

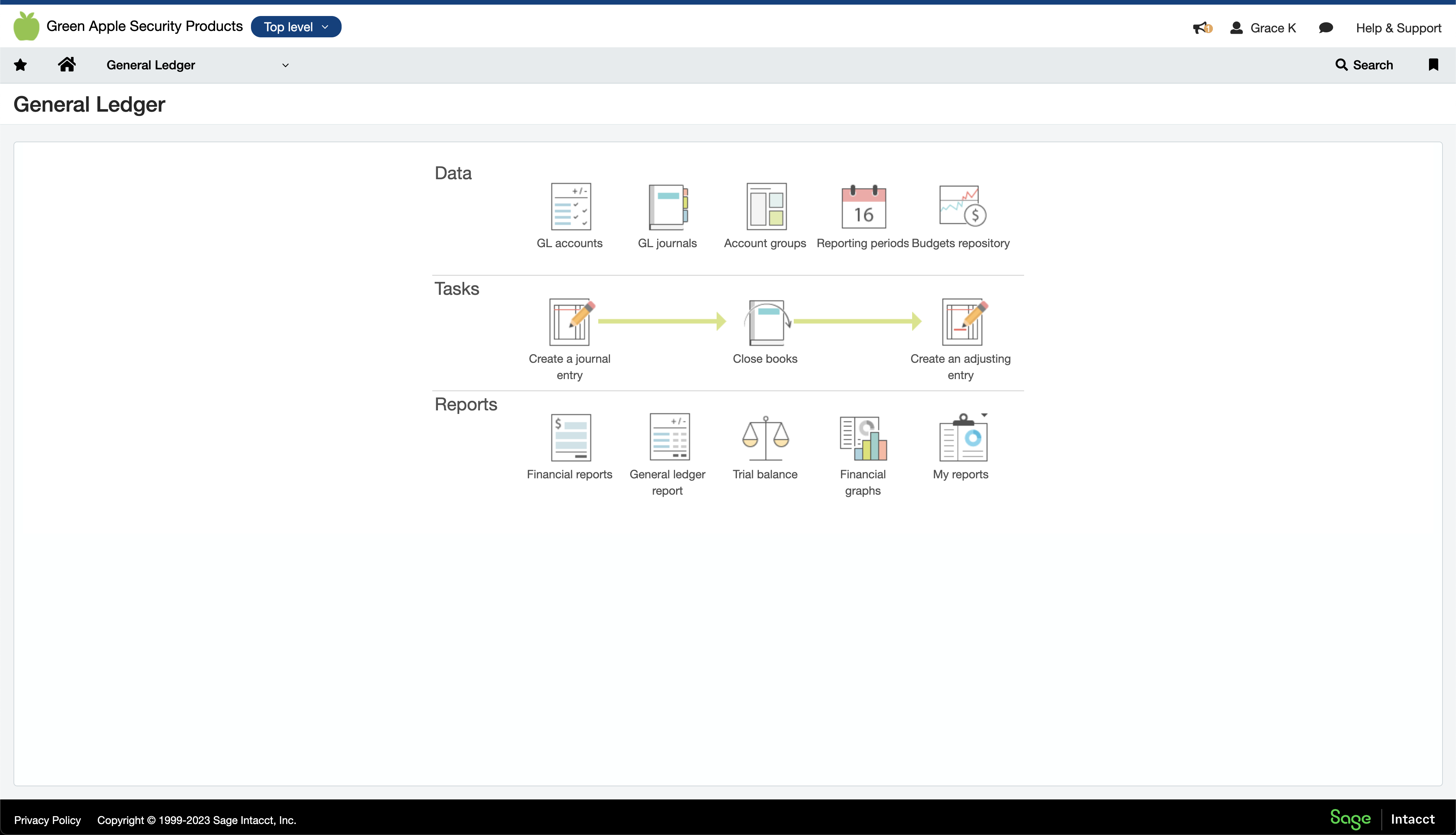

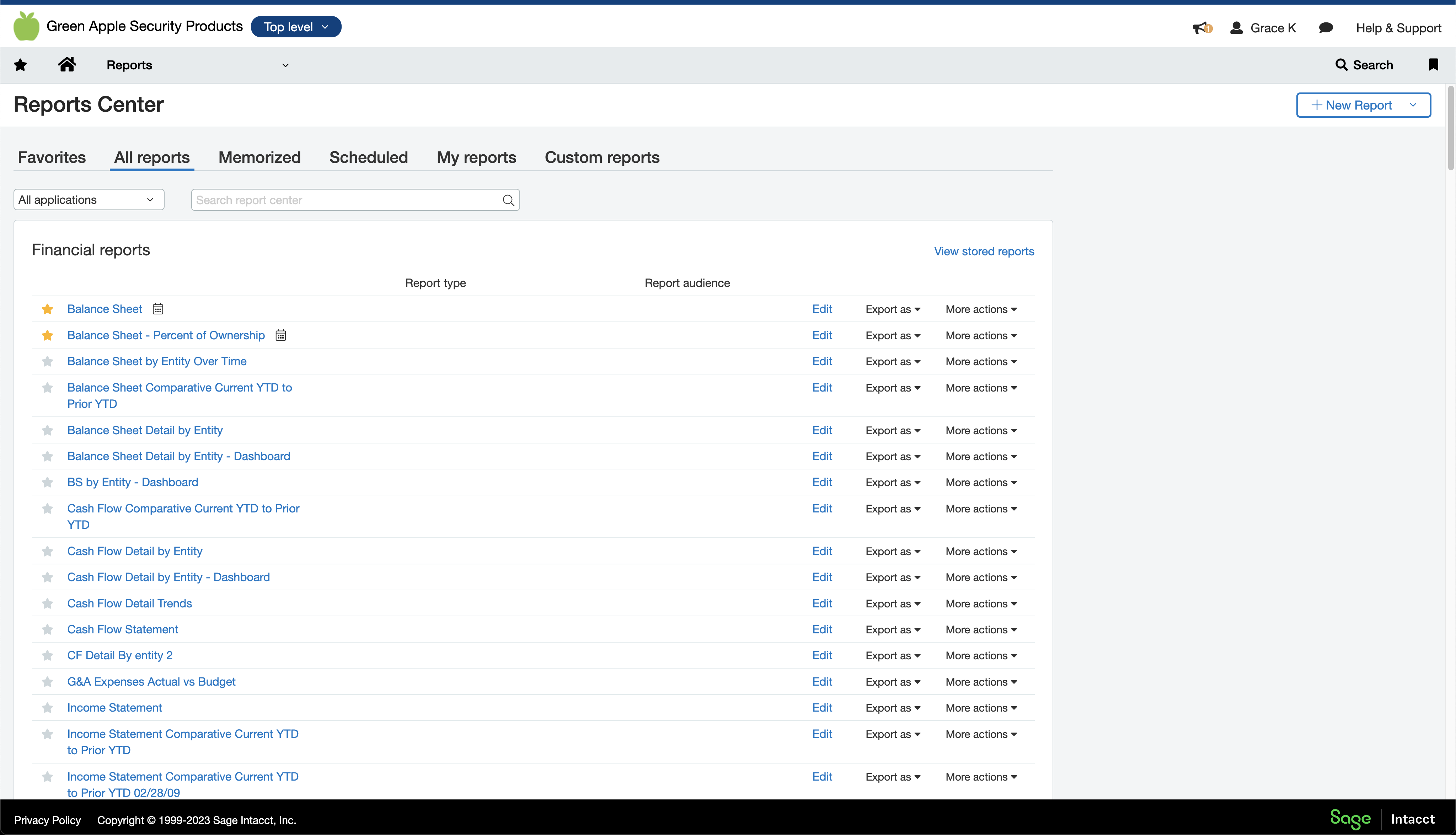

Sage Intacct is leading cloud-based accounting software for finance teams. With tools like automated workflows and built-in dashboards, Sage Intacct helps accounting professionals eliminate manual tasks and easily access up-to-the-minute business insights. The cloud platform allows CFOs to manage their financials anywhere, anytime and offers the ability to connect to a variety of other leading finance tools. Sage Intacct is rated #1 in customer satisfaction and is the only financial management solution endorsed by the AICPA.

Popular Integrations

Extend Sage Intacct’s capabilities through its extensive community of finance technology partners.

Streamline Publishing Shares Data Faster with Sage Intacct

“We can slice and dice our data however we need to and send as much or as little of it to people based on what they want to know. They are getting timely insight now because they don’t have to wait for us to run reports manually.”

—Laura Iserman, Director of Finance, Streamline Publishing

Recognition from Sage

Explore Our Sage Intacct Resources

Recent Articles

Check out our blog for helpful information about the role technology plays in accounting and finance.

Sage Intacct Review

We scoured Sage Intacct user reviews to find answers to the questions every potential buyer wants to know.

Modern Finance Webinar

Watch our Modern Finance Webinar to learn what technology means for the accounting industry.

Let’s Chat

Still have questions? Get in touch with our expert team of software professionals.